How to Set and Achieve Business Goals Easily

If you’re an entrepreneur or a business owner who feels stuck, overwhelmed, or unsure about what to do next, you’re not alone. Many people build

If you ask people to name one money book that truly changed them, most will mention Rich Dad Poor Dad. The book is life-changing because it simplifies money, wealth, and financial freedom in a way anyone can understand.

It makes you see money differently. It makes you think differently. It shows you that you don’t have to trade your life away for a paycheck. When I first read this book, I was completely confused about money. I didn’t know how to save. I didn’t know where to invest.

Affiliate Disclaimer: I earn commission (get paid) if you click on the links and purchase a product below. My earnings do not impact the price you pay.

I didn’t understand how the rich stayed rich. But this book shifted everything. It made me realize that the secret is learning how to make money work for you, not the other way around.

This guide will break everything down in the simplest way possible. I’ll highlight ideas like financial freedom, money mindset, and passive income. And I’ll use simple examples that even a beginner can apply.

By the end, you’ll understand how the book encourages real estate investing and why it’s one of the best beginner-friendly paths to wealth. Let’s dive in!

One of the strongest parts of the book is the contrast between Rich Dad’s thinking and Poor Dad’s thinking. Both dads loved their families. Both cared about education. But they saw money differently. That difference shaped how their lives turned out.

Example:

Poor Dad says, “Find a stable job with benefits.”

Rich Dad says, “Learn how to own something that pays you.”

I once talked to someone who realized she had accidentally followed Poor Dad’s mindset without knowing it. She did everything “right”: good grades, college, stable job. But she felt stuck financially. After learning about assets and cash flow, she understood she wasn’t building wealth. She was just working hard with nothing to show for it later.

Takeaway:

Your mindset is the foundation of your wealth. Change the way you think, and your money life begins to change too.

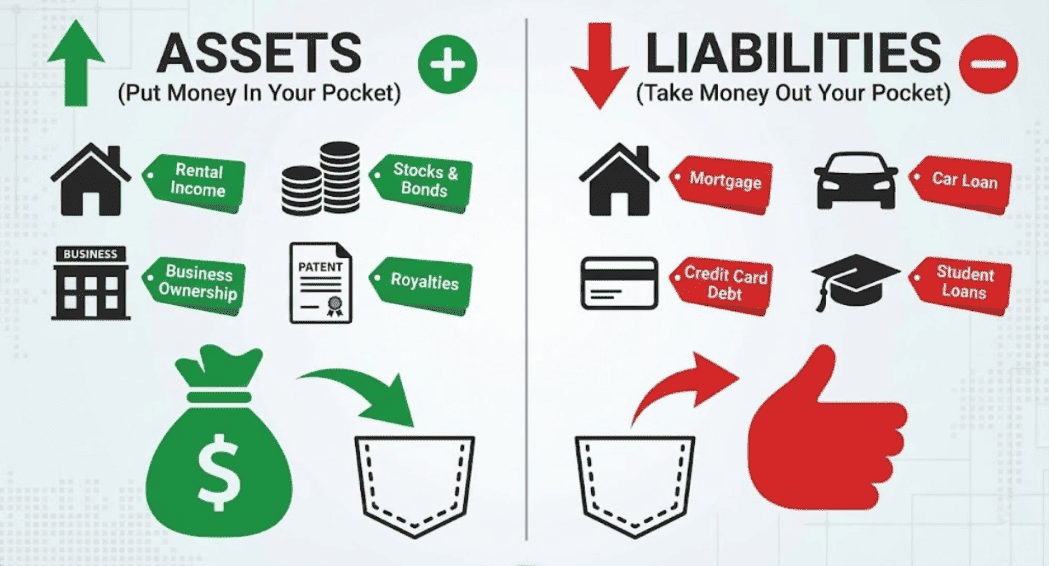

Many people misunderstand assets. They think an asset is something expensive. But the book explains it in the simplest way:

An asset is something that puts money in your pocket.

A liability takes money out of your pocket.

Real estate that earns rent is one of the best examples of a beginner-friendly asset.

The key idea is this:

Assets create income. Salaries don’t.

Your salary has a limit. It stays the same unless you work more hours or get promoted. But cash flow from assets can grow without you working harder.

Real Assets:

Disguised Liabilities:

Takeaway:

Focus on assets first. They build long-term wealth.

Real estate is one of the easiest assets for beginners to understand. It’s simple. It’s physical. It has clear rules. And it creates wealth through three main paths:

This is the monthly money you collect from tenants. This creates rental cash flow, one of the strongest ways to build stable income.

Land and housing tend to increase in value over time. That means your asset becomes more valuable without extra effort.

This means using a loan or mortgage to buy a property. You pay a small amount, but you control a large asset. It multiplies your wealth-building power.

Example:

Buying a small rental room or a tiny shop space in your city may seem small. But if it earns even a little rent every month, it becomes a long-term asset that grows.

I know someone who bought a tiny piece of property that most people ignored. It wasn’t fancy. It wasn’t in the best location. But it earned a small rent. Years later, the area developed and the property value doubled. That small decision changed his financial life.

Takeaway:

Real estate gives you ownership, rental cash flow, and long-term wealth building.

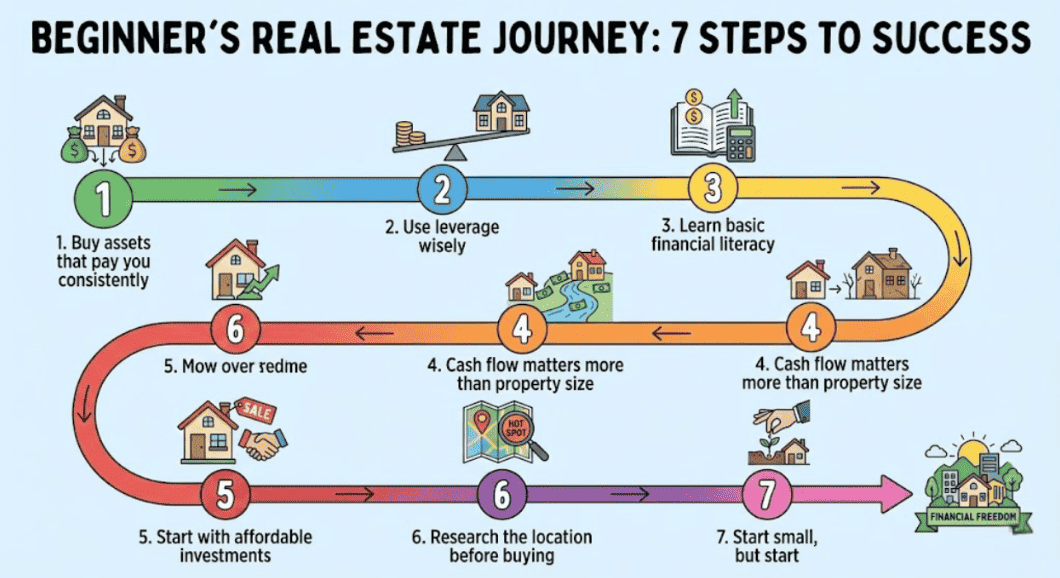

Here are simple, beginner-friendly lessons inspired by Robert Kiyosaki:

If it earns money monthly, it’s worth considering.

Debt is not the enemy. Bad debt is. Good debt builds cash flow.

Know the difference between assets and liabilities.

A small room that earns rent is better than a large house that drains money.

Small steps build confidence.

The right location can multiply your returns.

Nothing changes until you take action.

Story Example:

A woman once started with a tiny rental room behind her house. It wasn’t special. It wasn’t impressive. But it earned consistent rent. That cash flow gave her confidence to buy a second property. Years later, she owned four properties. She started small and grew steadily.

This one habit builds natural real estate awareness.

Takeaway:

Cash flow first. Learn before you invest. Start small. These three ideas can change your future.

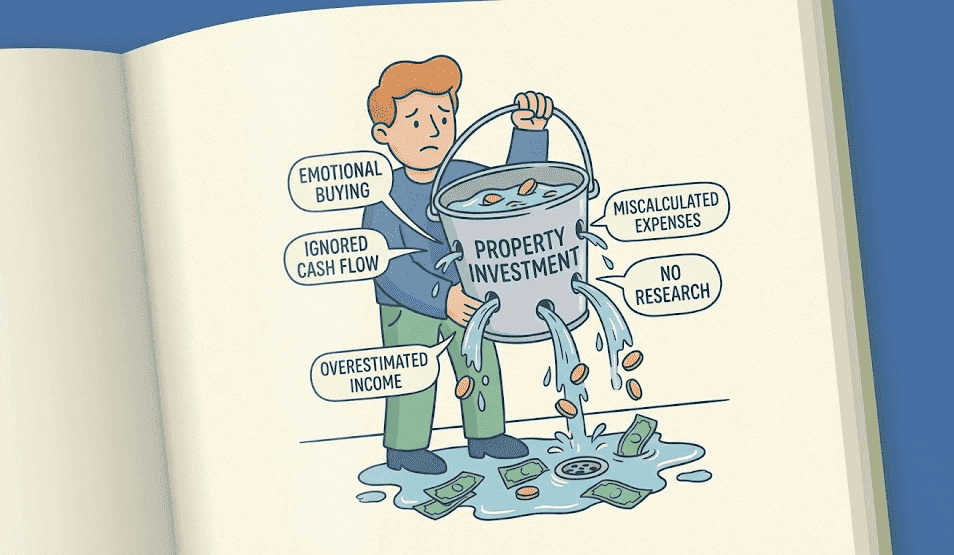

Beginners make the same mistakes again and again. You can avoid most of them simply by being aware.

Buying emotionally:

Choosing property because it “looks nice,” not because it earns money.

Ignoring cash flow:

Focusing only on property price, not monthly income.

Overestimating rental income:

Assuming higher rent than the market allows.

Not calculating expenses:

Taxes, repairs, maintenance, and vacancy can eat your profit.

No research:

Buying in the wrong area without checking demand.

Example:

Many beginners fall in love with a pretty house. They imagine it will somehow earn money. But if the numbers don’t work, it’s not an asset.

Takeaway:

Do the math, avoid emotional buying, and research first.

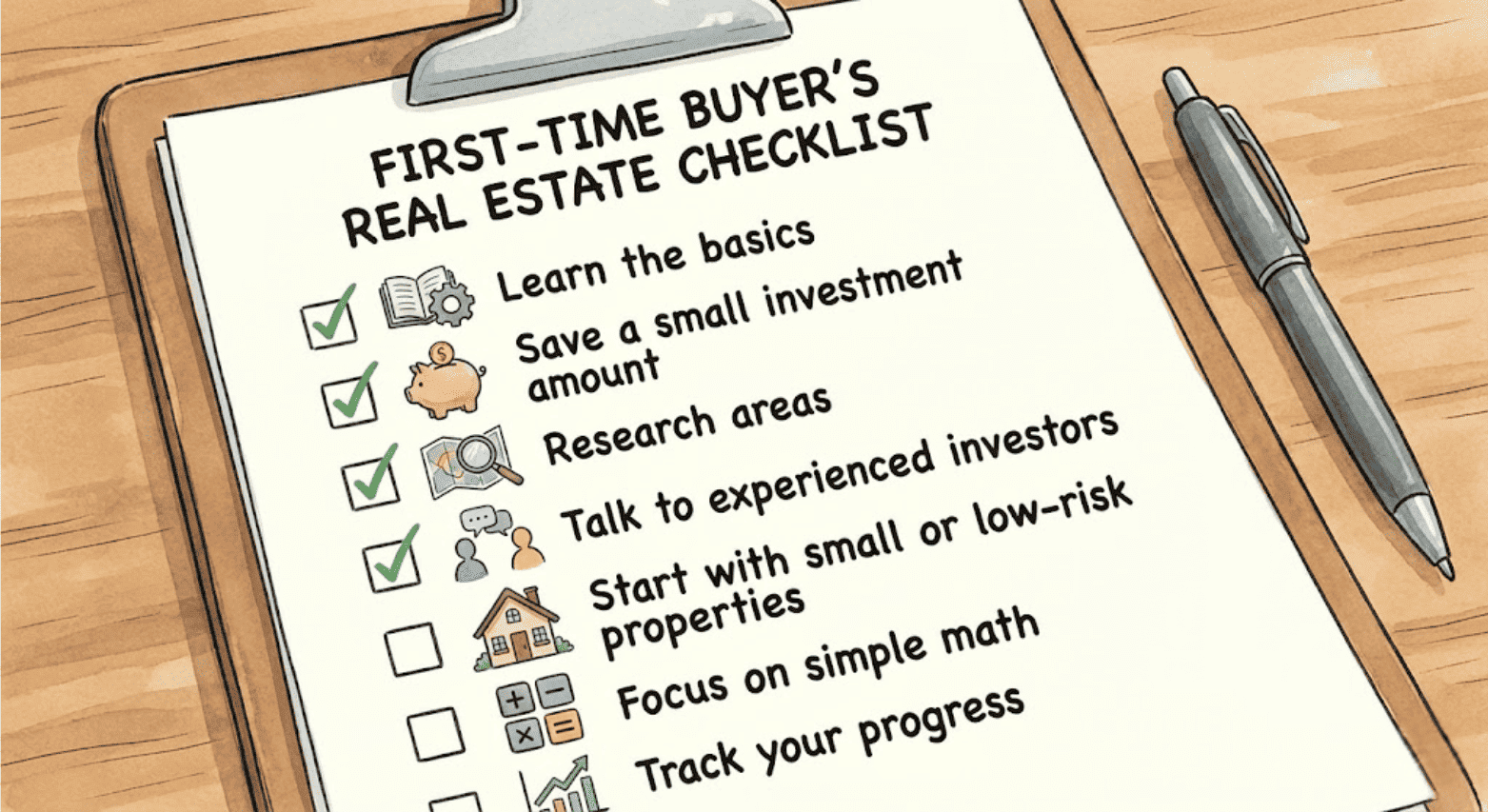

Here is a simple beginner-friendly action plan you can start today:

Understand assets, cash flow, and rental demand.

You don’t need a huge amount to start. Even a small plot or room is enough.

Walk around. Talk to locals. Understand rental prices.

Learn from people doing it. Ask questions.

Your first investment doesn’t need to be big. It just needs to be profitable.

Income must be higher than expenses.

Keep notes. Learn what works and what doesn’t.

Key Message:

Adding real estate becomes easier once you understand the numbers.

Takeaway:

Take the first step, learn consistently, and start within your budget.

Rich Dad Poor Dad teaches one simple truth:

Your mindset shapes your financial future. If you think like the poor, you’ll work for money forever.

If you think like the rich, you will learn to build assets and let them create wealth for you. When you combine mindset + assets, you create long-term financial success.

Start small. Start simple. But start today. Take action. Build assets. Think like Rich Dad. Your financial transformation begins with one small step.

If you’re an entrepreneur or a business owner who feels stuck, overwhelmed, or unsure about what to do next, you’re not alone. Many people build

Starting an online business feels exciting at first, but the money side can get confusing fast. Many beginners jump in with enthusiasm but feel lost

You’re new. You’re creative. You’re overwhelmed. The online branding world looks huge. It looks full of experts and loud voices. It looks complex. Many beginners

Copyright 2021 Dwayne Graves Online | All Rights Reserved |